Stop worrying about compliance and second-guessing your next move – we've got you covered for the next 6 months!

This offer allows you to hire one of the world-leading compliance expects to help you compete a specific project or solve a complex issue during the 6 months timeframe relying on our FinTech industry insights and best practices that are working right now! We will set up all essential aspects, policies, contractual framework and processes of your compliance program and then help you hire and train your compliance team to be able to manage your future compliance program efficiently and on a budget!

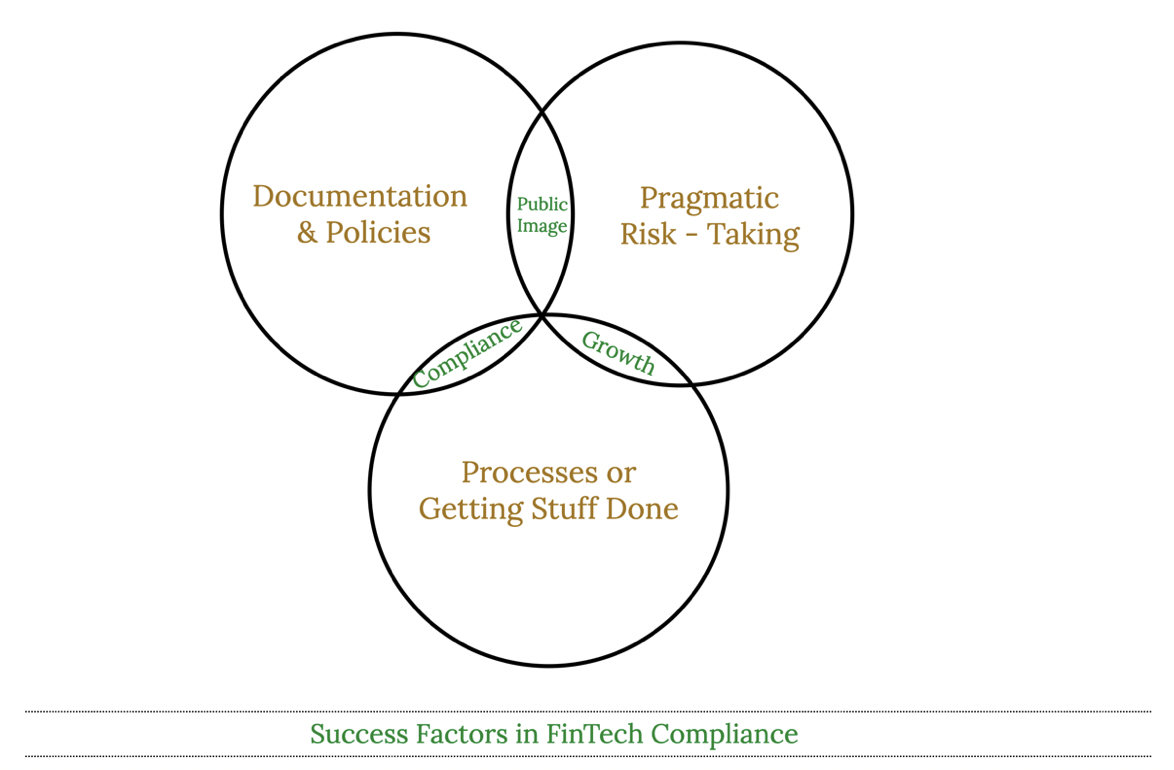

Our approach is based on "Just-in-Time" principles as a foundation of agile, scalable and results-oriented compliance:

- Documentation and policies

- Pragmatic risk acceptance

- Operational efficiency

Why these 3 components are so essential?

- Pragmatic risk acceptance combined with efficient processes will create growth and scale.

- But… without documentation and policies, you will experience an “undocumented growth” which is a problem, when it comes to securing important partnerships and licenses.

- Efficient processes combined with documentation will equal compliance because you do what your policies say, but without risk-taking, you end up being a conservative, rigid old-fashioned bank.

- Risk-taking combined with great documentation will create a great public image, but if you don’t actually do what your policies say, it is window-dressing, and you’ll get caught.

WHAT IS INCLUDED?

We will provide (review or create) and customize the following set of policies for your company:

- AML, KYC, PEPs, sanctions policies and SOPs, onboarding flow setup guide (including policies, tools review, and guidance on admin and case management setup)

- Privacy and GDPR module, including privacy policy, GDPR compliance policy, binding corporate rules, and standard contractual closes or Data Transfer Appendix template (to be included in all your contracts with vendors and payments partners where data transfer is involved)

- Outsourcing framework setup, including outsourcing policy template and outsourcing assessment checklist

- Consumer and Investor Protection, including Customer Protection and Complaints Handling Policy, Investor Protection Policy, and Customer Funds Safeguarding Procedure (for fiat and crypto services)

- Information Security, including InfoSec policy, incident management, and business continuity policy

- Blockchain-specific regulations, including Blockchain Operational compliance policy

- Corporate Governance and Board of Directors set up, Code of Conduct, Segregation of Duties guidance, Anti-Bribery and Corruption procedure, and other relevant templates (e.g. gift policy, HR screening, etc.)

- Business-wide risk assessment and product risk assessment (with dedicated sections for AML, Product, VASPs, General Risks, Financial Risks, Startup Risks, and Regulatory Risks)

- Risk Management, Assessment, and Fraud Prevention, including relevant Risk Management policy and Risk Assessment and Risk Assessment methodology templates

- Conflict of Interests and Insider Trading Policy

- Terms of Service, Affiliation and Loyalty Programs structuring (including sample language for loyalty points or reward programs, beta testing provisions, and affiliation program templates)

- Inter-Company Agreements and SLAs

- Detailed and comprehensive Annual Compliance Plan and sample Internal Audit Plan. Compliance Assurance Framework (roles of FLOD, SLOD, audit)

- FinTech Licensing - including License Application Template, financial projections template, business plan template, FinTech licensing roadmap, first regulatory inquiry template

- Token listing and token assessment criteria (for cryptocurrency exchanges or wallets).

- FATCA and CRS compliance policy

* * * FINTECH STARTUP COMPLIANCE PRO CERTIFICATION * * *

This program allows one of your team members to complete our very unique FinTech Compliance certification that will prepare you to handle the most common compliance challenges and will elevate your competence and confidence to the next level where you feel ready not only to set and manage a superb compliance program within your FinTech startup, but will have a framework for making pragmatic risk-based decisions.

In addition to the pre-recorded curriculum, workshops, and instant access to all templates, they will have access to additional training and coaching focused on the most relevant and complex FinTech compliance performance and leadership topics. The total of 4 LIVE training group calls are included to help you implement our content within your company and prepare you for the final assignment.

The Certification Schedule for 2024

3 cohorts are currently planned for 2024:

- Starting on January 20 and graduating by April 15.

- Starting on April 15 and graduating by August 15.

- Starting on September 16 and graduating by December 16.

Remember, success in the FinTech compliance formula is 10% regulatory knowledge and 90% decision-making, negotiations, and leadership skills.

Below is the Certification-specific curriculum:

- Goal-setting. Our first group call is a workshop dedicated to goal-setting, determining specific deliverables or professional results each participant decides to set for themselves or their function.

- Manage regulatory change. Our second workshop is dedicated to developing the skills needed to prepare and manage any regulatory change. We will use the example of MICA Regulation and Funds Transfer Regulation. The purpose of this project is to shift away from the traditional methodology of gap analysis followed by the list of 100+ requirements that hypothetically need to be implemented and create a simple, actionable plan of implementing any regulatory change.

- Preparing compliance ROI. We will have a special training where the participants will have to analyze key components of the compliance costs and the composition of the compliance budget. They will have to prepare a project budget for a new compliance initiative using ROI (Return on Investment Method) and position this request as a request coming from a revenue-generating unit rather than a cost-center unit.

- Developing Annual Compliance Plan . Organizational structure. Hiring and firing principles. Setting Revenue-generating objectives for the next year. Making ROI-based resource needs estimates. Defining KPIs for all key compliance areas: new products, AML, risk management, reporting, outsourcing, funds safeguarding, and governance.

- Behaviors that keep us stuck. Everyone who was unable to take an agreed-upon action, feels “behind” or otherwise is unhappy with their progress, will have to assess what is preventing them from taking a different action and will get coaching and feedback on how to make the changes they desire to see.

Final Assignment – where can you take more risks? The participants will have to identify, prepare, and justify a case study about where their function or company should take more risks.

* * *

Recorded project management workshops and video trainings that are instantly available for all your team members:

- Rise of the Business-Like CCO introductory training.

- Opening bank account and preparing for banking due diligence roadmap

- FinTech Licensing workshop and licensing planning roadmap

- FinTech Risk Assessment workshop

- Structuring White-Label Solutions in FinTech

- Onboarding of corporate customers workshop

- Creating your FinTech Privacy Policy and GDPR Compliance

- Preparing for and managing FinTech AML and operational audits

- Annual compliance reporting requirements for FinTech workshop (all mandatory reports templates included)

- Documenting your Outsourcing workshop

- Compliance Performance and Resource Management

- End-to-end Crypto Compliance Workshop (including a separate dedicated training on how to comply with Apple and Appstore Guidelines)

... plus new content and templates are added regularly!

CONSULTING SERVICES:

How our approach is different from the traditional compliance courses:

- OLD WAY: Traditional compliance assigns responsibility to the “tone at the top”, removes responsibility for risk management from compliance stating that “business must own their risks” and describes compliance as an advisor, providing feedback and reporting to the senior management. According to this outdated theory, compliance can only be blamed or found guilty if it did not detect some risks or irregularities and/or did not warn or escalate the issues accordingly. Every single time we read about the fact that some high-profile bank had been fined by their regulator for money-laundering breaches or excessive risk-taking, you will see and hear the same story: compliance and risk identified and escalated the issues or potential risks well in advance and repeatedly, the problem was discussed by the board and various committees and then the was a collective decision to go ahead and do (or allow) the activities that happened. Assigning responsibilities to the top and isolating compliance from business and risk-taking decisions does not produce better compliance or better business outcomes.

- New WAY: Our approach is focused on making sure that compliance is the ultimate decision-maker. Compliance leaders want to be included, respected, and appreciated for their insights. But this respect cannot be earned if you are not responsible for anything and have no skin in the game. We teach you how to take risks that you are comfortable with and can defend in front of others.

- OLD WAY: Traditional compliance scholars will tell you that the key to compliance success is to make sure compliance gets adequate resources and more senior management attention. What’s wrong with this? Ask any CEO and/or CFO of any financial institution or even a smaller FinTech (off the record, obviously) and they will tell you how they spend a disproportionate amount of time in compliance-related, audits, risk reviews, and similar meetings, where they learn nothing new, decide very little and don’t see things improving. The more resources traditional companies and scale-up FinTechs invest into compliance, the more new issues they identify that need to be solved. The biggest compliance fines are very often paid by the biggest banks.

- NEY WAY. We teach you and will ask you to prepare an assignment on how to do the right things at the right time and how to take pragmatic risks without compromising compliance objectives.

- OLD WAY. Traditional compliance scholars view compliance as a cost function, that needs to receive an appropriate budget. Traditional compliance certification training won’t teach you modern project management skills, or project prioritization skills, or pragmatic risk-taking skills. They teach you “how to be on the safe side”, “protect your back” skills, and “better safe than sorry” strategies. When you don’t get things done and cannot prioritize available resources and won’t help your company achieve its strategic goals, objectively speaking, you add zero value to the company.

- NEW WAY. We will teach you how and will ask you to prepare an ROI assessment for your compliance budget, and by the end of the program, you will be ready to act like a business-like CCO.

* * *

Please note that this offer is non-refundable

Logistics: After you have made the payment, we will reach out to you to setup a kick-off call and define our goals for the next 6 months of working together.

Also, all your team will be granted access to the password-protected area of the learning portal where all recorded content and templates will be delivered.

Questions? – yana@competitivecompliance.com

Terms of Service