This program offers you step-by-step guidance on how to set up and manage all essential aspects of your FinTech Compliance program – efficiently and on a budget!

Whether you are a seasoned compliance executive, mid-level compliance expert or a founder handling your company's compliance, the worst possible mistake in compliance is starting from scratch! Stop reinventing policies, processes, or documentation for partners – we've got you covered!

This program is a comprehensive implementation blueprint including everything you need to set up and manage compliance function within your FinTech or Crypto business.

The program includes two tracks:

-

FinTech Compliance Self-Starter is a set of instantly available pre-recorded trainings, implementation guides and documentation templates.

-

Interactive trainings, live sessions, coaching calls and the final assignment, leading to the CPD-accredited and formally recognized FinTech Startup Compliance Pro Certification.

You will get training videos, metrics to track progress, and implementation guides for all recurring compliance projects: from assessing and optimizing your customer onboarding flow, managing license applications to preparing for and successfully completing audits and regulatory inspections, learning how to responsibly allocate your limited resources between hiring employees versus external help versus investing into tools and automation at the right time.

You will also get instant access to over 40+ compliance templates (continuously updated), SOPs, T&Cs, checklists, policy examples, and even a sample license application document to save you valuable time and help you focus on growing your business, building the team and keeping your partners and customers happy.

Compliance Self-Starter is available at all times and also includes access to future updates for all policies and trainings.

The Certification program (live interactive component) runs a few times a year, each cohort has the fixed start and graduation dates. These live trainings will equip you with implementation guidance you need to set up and manage an adequate compliance program within your startup even faster.

Within the first 60 days of the program you are likely to experience the following results:

- You will know how to differentiate real risks from imaginary risks. Once you will have learned how to calibrate your business risks, you can confidently focus on projects that add the most value and eliminate your biggest risks.

- You will know exactly how to quantify and communicate the value of compliance, how to confidently present your proposals and budget requests and get them approved.

- Your company will have a blueprint for key interactions with auditors, regulators, banks and financial partners. No second-guessing needed.

How is this program different from any other compliance training?

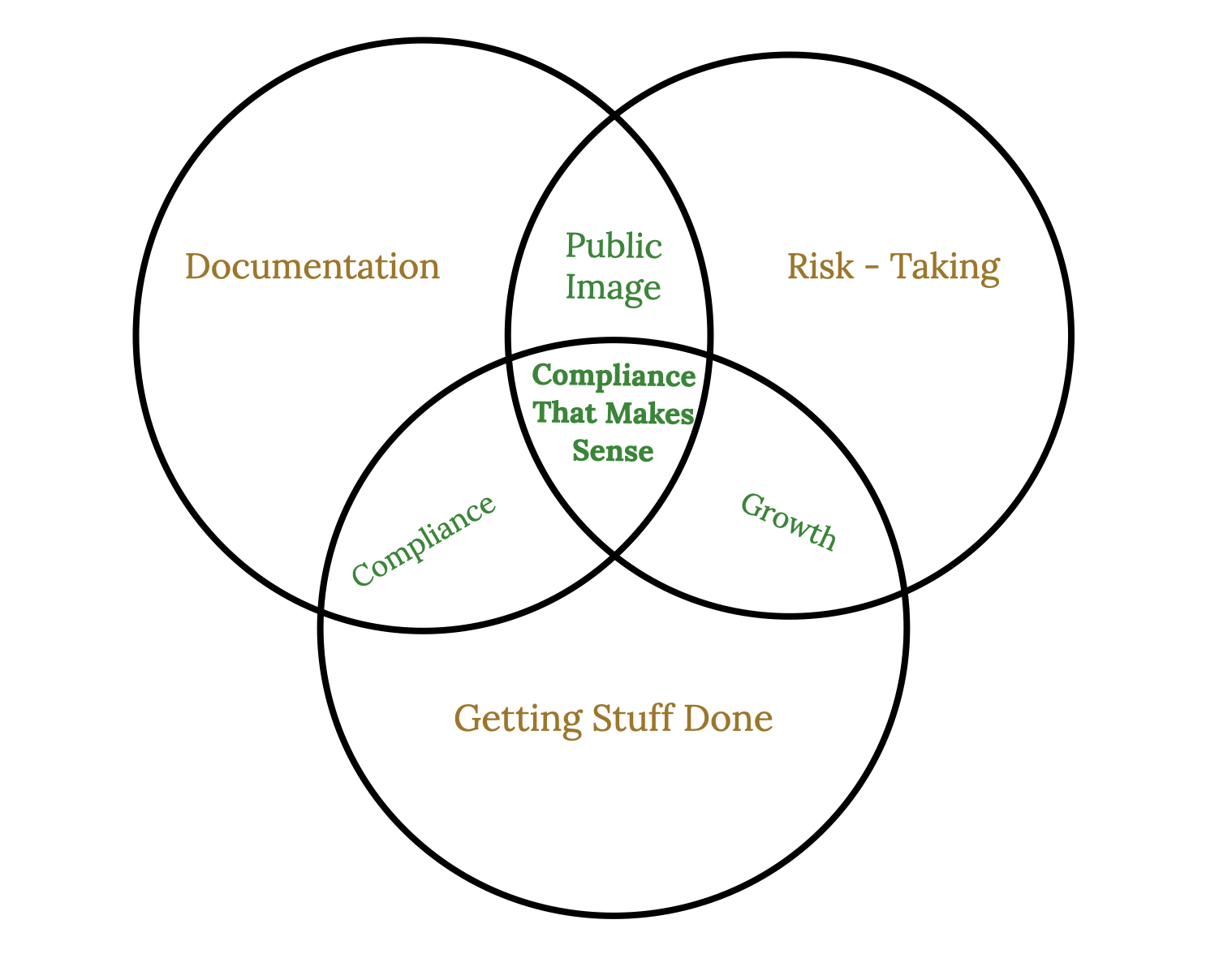

Our approach is based on the 3 pillars of "Just-in-Time" (as opposed to outdated "Just-in-Case"), scalable and results-oriented compliance:

- Operational efficiency (just-in-time processes)

- Documentation (your policies and procedures)

- Decisions (pragmatic risk-taking)

Why are these 3 components so essential?

- Pragmatic risk-taking combined with efficient processes will create growth and scale.

- But… without documentation and policies, you will experience an “undocumented growth” which is a problem, when it comes to securing important partnerships and licenses.

- Efficient operational processes combined with documentation will equal compliance because you do what your policies say, but without risk-taking, you end up being a conservative, rigid, old-fashioned bank.

- Risk-taking combined with great documentation will create a great public image, but if you don’t actually do what your policies say, it is just a window-dressing, and you’ll get caught.

That is why you absolutely need all 3 Just-in-Time compliance pillars to be able to scale your FinTech compliance program.

WHAT IS INSIDE: 3 PILLARS OF JUST-IN-TIME COMPLIANCE

1. Operational Efficiency. Implementation workshops for all critical aspects of compliance operations are included:

- Opening bank accounts

- Managing your own FinTech licensing: MICA or FinTech Licensing for Self-Starters package.

- Preparing Business-Wide Risk Assessment

- Structuring White-Label solutions. Choosing between the white-label and your own licensing

- FATCA/CRS implementation workshop

- Onboarding and risk-rating for corporate customers

- Cross-border services and reverse solicitation

- Performing due diligence of your future financial partners (to avoid the risk of over-reliance on Wirecard, FTX or Railsbank)

- Creating your FinTech Privacy Policy and managing your GDPR compliance

- End-to-end Blockchain Compliance

- Preparing for and managing external audits

- Standardizing and simplifying you annual compliance reporting

- Complying with Apple and Google Appstore Guidelines

- DORA Compliance. Documenting your Outsourcing

- Implementing Russia-related sanctions within FinTech and Crypto startups

- Digital Services Act implementation

2. Documentation and Policies Templates

Our tried-and-tested templates are continuously fine-tuned and updated, based on feedback received from our clients.

This package of FinTech Compliance templates is updated for 2026, and includes all mandatory elements to set up your FinTech compliance documentation:

- AML, KYC, PEPs, sanctions policies and SOPs, onboarding flow setup guide (including policies, tools review, and guidance on admin and case management setup)

- Privacy and GDPR module, including privacy policy, GDPR compliance policy, binding corporate rules, and standard contractual closes or Data Transfer Appendix template (to be included in all your contracts with vendors and payments partners where data transfer is involved). Digital Services Act implementation guide.

- Outsourcing framework setup, including outsourcing policy template and outsourcing assessment checklist

- Consumer and Investor Protection, including Customer Protection and Complaints Handling Policy, Investor Protection Policy, and Customer Funds Safeguarding Procedure (for fiat and crypto services)

- Information Security, including InfoSec policy, incident management, and business continuity policy, including DORA-compliant disclosures.

- Blockchain-specific regulations, including Blockchain Operational compliance policy

- Corporate Governance and Board of Directors set up, Code of Conduct, Segregation of Duties guidance, Anti-Bribery and Corruption procedure, and other relevant templates (e.g. gift policy, HR screening, etc.)

- Business-wide risk assessment and product risk assessment (with dedicated sections for AML, Product, VASPs, General Risks, Financial Risks, Startup Risks, and Regulatory Risks)

- Risk Management, Assessment, and Fraud Prevention, including relevant Risk Management policy and Risk Assessment and Risk Assessment methodology templates

- Conflict of Interests and Insider Trading Policy

- Terms of Service, Affiliation and Loyalty Programs structuring (including sample language for loyalty points or reward programs, beta testing provisions, and affiliation program templates)

- Inter-Company Agreements and SLAs

- Detailed and comprehensive Annual Compliance Plan and sample Internal Audit Plan. Compliance Assurance Framework (roles of FLOD, SLOD, audit)

- FinTech Licensing - including License Application Template, financial projections template, business plan template, FinTech licensing roadmap, first regulatory inquiry template

- Token listing and token assessment criteria (for cryptocurrency exchanges or wallets).

- FATCA and CRS compliance policy.

- MICA-specific policies and disclosures.

3. The FinTech Startup Compliance Pro Certification

The certification track is the 3rd and the most important pillar of the Just-inTime method. It will prepare you to responsibly and pragmatically take more risks, handle ambiguity, set priorities, find answers to questions that cannot be found by reading laws and circulars, and handle most common compliance challenges. It will elevate your competence and confidence to the next level where you feel ready not only to set and manage a superb compliance program within your FinTech startup, but will have a framework for making pragmatic risk-based decisions.

The Certification Schedule for 2026

If you would like to pursue the official certification as a "Certified Startup FinTech Compliance Pro", you will be asked to prepare your case study project, which will be assessed and graded. Remember, success in the FinTech compliance formula is 10% regulatory knowledge and 90% decision-making, negotiations, and leadership skills.

Below is the Certification-specific curriculum.

2 cohorts are planned for 2026:

- Starting on April 22nd and graduating by July 22nd 2026. OPEN!

- Starting on September 16th and graduating by December 16th 2026.

All live trainings will take place on Wednesdays at 2 pm CET (and are always recorded) between April 22nd and July 15th 2026:

1.April 22nd 2026. Goal-setting.

2. April 29th 2026. Managing regulatory uncertainty training is dedicated to developing the skills needed to prepare and manage any regulatory change. Participants can choose between:

- How to offer cross-border services and reverse solicitation (LIVE) deploying tried and tested strategies for geo-expansion.

- DORA implementation (pre-recorded)

- Digital Services Act ("DSA") implementation, in particular how DSA interacts with GDPR and privacy requirements. (Pre-recorded)

3. May 6th 2026. Managing Compliance Function as a Profit Center. Preparing compliance ROI and communicating the value of compliance with stakeholders. Optimizing compliance operations using marketing and finance data.Setting up and optimizing onboarding flows and transaction monitoring rules.

4. May 13th 2026. Developing Annual Compliance Plan, Compliance KPIs and Policy Framework training covers the following areas:

- Organizational structure

- Hiring and firing principles

- Setting revenue-generating objectives

- Making ROI-based resource estimates

- Defining KPIs for all key compliance areas: new products, AML, risk management, reporting, outsourcing, funds safeguarding, and governance.

- Maintaining policy framework

5. May 20th 2026. The biggest risks for your business. Business-Wide Risk Assessment. We will go beyond the traditional risks and cover product strategy, team competency, problematic partnerships, incidents, losses).

6. May 27th 2026. BONUS TRAINING. Communications with stakeholders using NLP methodology to resolve conflicts, overcome biases and remove objections.

7. June 3rd 2026. Instructions to Prepare for the Final Assignment – where can you take more risks? The participants will have to identify, prepare, and justify a case study about where their function or company should take more risks.

Deadline for submitting your Final Assignment: July 10th 2026.

Graduation: July 15th 2026

Certification Benefits: depending on your company's policies, the official certification status of the program can potentially help you claim the cost reimbursement and/or additional study leave or time-off. You will receive the proof of the 30 hours invested into continuous education.

Eligibility requirements for successful completion of the Certification

- You must attend live or watch the recordings of 10 workshops included into the Self-Starter package.

- You must attend live or view the recordings of all 5 specific workshops that are mandatory for the Certification.

- You must successfully complete the final assignment.

Grading Criteria for the Final Assignment

Your final assessment should describe a new initiative, new project, new opportunity, or new methodology ideally related to the goal that you identified during our first session. It should be approximately 4-6 pages long and must be a narrative/analysis.

Post Certification

Your access to the FinTech Compliance Self-Starter content and Certification training is not time-limited. It means that you will automatically get access to new recordings and document updates and new versions of templates and trainings. You are welcome to view any future recordings of any updated version of the training or workshops and download any future templates that will be added to the program at any time. No additional payments are required.

* * *

HOW TO ASK YOUR COMPANY TO APPROVE THIS INVESTMENT ?

Download this reimbursement request letter and send it to your boss.

* * *

Please note that this offer is non-refundable as soon as you access the content.

Logistics: After you have made the payment, you will be granted access to the password-protected area of the course portal where all recorded content and templates will be delivered to you. You will be prompted to create your login and password which you will need to access the program recordings at any time in the future. The schedule will be communicated over email.

Questions? – yana@competitivecompliance.com

Terms of Service